- Monday Momentum

- Posts

- Navigating the Yen Carry Trade Pullback

Navigating the Yen Carry Trade Pullback

Identifying key investment opportunities and understanding what, exactly, happened

The markets were riding a strong wave of optimism, fueled by a combination of positive earnings, robust economic data, and sustained low interest rates across major economies. But as any seasoned investor knows, markets don’t move in a straight line. The recent pullback, triggered by shifts in the yen carry trade, has caught many off guard. For some, this market correction is a source of anxiety; for others, it’s a signal to reevaluate and seize new opportunities. Understanding the forces at play is crucial to making informed decisions in the current environment.

Understanding the Yen Carry Trade: A Deep Dive

The yen carry trade has been a cornerstone of global financial markets for years, particularly during periods of low interest rates. At its core, the strategy is simple: investors borrow in a currency with low interest rates—traditionally the Japanese yen—and invest in assets that offer higher returns, such as stocks, bonds, or real estate in other countries. The difference between the low borrowing costs in yen and the higher returns on the investments made is the profit margin for these traders.

Why the Yen?

Japan has maintained near-zero or even negative interest rates for a prolonged period, driven by the Bank of Japan’s efforts to combat deflation and stimulate economic growth. This policy environment makes the yen an attractive currency to borrow, as the cost of servicing yen-denominated debt remains low. Additionally, Japan’s stable economic environment and relatively low inflation rates have kept the yen as a safe currency for such trades.

How the Carry Trade Works

Here’s a simplified example: An investor borrows 100 million yen at an interest rate close to zero. They convert this amount into U.S. dollars, investing the equivalent in U.S. Treasury bonds yielding, say, 3-4%. As long as the yen doesn’t appreciate significantly against the dollar, the investor earns the spread between the near-zero borrowing cost and the bond yield—effectively pocketing the difference.

This strategy can be highly profitable in a stable market environment where exchange rates and interest rates don’t fluctuate dramatically. However, it comes with risks. If the yen appreciates against the target currency (say, the dollar), the cost of repaying the yen-denominated loan increases, potentially wiping out the profits or even leading to losses. Additionally, any unexpected rise in Japan’s interest rates could also increase the cost of borrowing, reducing the attractiveness of the trade.

The Recent Pullback: What Changed?

Recently, signals from the Bank of Japan suggested a possible shift towards tightening monetary policy—perhaps by raising interest rates or reducing their bond-buying program. This would increase the cost of borrowing in yen, making the carry trade less attractive. At the same time, rising global bond yields, particularly in the U.S., have introduced more volatility into the bond markets, which many carry traders rely on for steady returns.

As a result, investors began unwinding their yen carry trade positions, leading to a rapid outflow of capital from riskier assets back into safer ones. This repatriation of funds can cause broad market sell-offs, as seen in the recent pullback. The unwinding of carry trades often leads to a strengthening of the yen, further exacerbating the losses for those still holding onto their positions.

Understanding the mechanics and risks of the yen carry trade is essential for grasping why its unwinding can have such a pronounced impact on global markets. While this strategy has fueled market rallies in the past, it also has the potential to trigger corrections when conditions change.

Investment Opportunities in the Wake of the Pullback

In the aftermath of this pullback, the focus shifts to where opportunities may arise. One thing to keep in mind is that the best time to strike was when there was wholesale panic at the beginning of last week. Several growth tech stocks or smaller caps were hit particularly hard by the carry trade aftermath. Being able to tolerate risk and pounce when others are scared can pay handsomely. Shopify, for example, increased by more than a third from Monday morning through the end of the week. While the unwinding of the yen carry trade has created short-term volatility, it has also reset valuations and opened doors for strategic investments.

High-Quality Equities: The broad market sell-off has dragged down many high-quality stocks along with it. Companies with strong balance sheets, robust cash flows, and sustainable competitive advantages are well-positioned to bounce back. The technology sector, despite its volatility, continues to offer long-term growth prospects, especially in areas like cloud computing, AI, and cybersecurity.

Emerging Markets: Some emerging markets, which were previously buoyed by inflows from the yen carry trade, may now appear oversold. These markets, particularly those with sound economic fundamentals and exposure to commodities, could offer compelling value as they stabilize and adjust to the new market conditions.

Commodities: The pullback has also created opportunities in the commodities sector. Metals such as copper and lithium, essential to the ongoing energy transition and tech manufacturing, are worth a closer look. Additionally, the energy sector, including oil and natural gas, could see a recovery as global demand dynamics shift and stabilize. There are several widely-available ETF’s which track baskets of commodities for different sectors - these are worth exploring.

Fixed Income: The market recalibration has widened spreads in certain areas of fixed income, making select high-yield bonds or emerging market debt more attractive. Bonds with solid fundamentals may now offer a more favorable risk/reward balance, particularly for income-focused investors.

Real Estate: Certain segments of the real estate market, especially commercial properties in prime locations, could become more appealing as financing costs evolve. REITs with exposure to data centers, logistics, or specialized sectors like healthcare facilities may offer a blend of yield and growth potential in this environment.

Focus on Fundamentals and Strategic Opportunities

The unwinding of the yen carry trade has undoubtedly introduced new challenges to the market, but it also brings opportunities for those who remain focused and strategic. By keeping an eye on quality investments, understanding the fundamentals, and being prepared to act when opportunities arise, investors can navigate this period of volatility and position themselves for future success.

This pullback isn’t a time to retreat—it’s a time to sharpen your strategy and find the next big play.

TL; DR - The recent market pullback has been driven by the unwinding of the yen carry trade, where investors borrow in yen at low interest rates to invest in higher-yielding assets. With Japan signaling potential shifts in monetary policy and rising global bond yields, the economics of this trade have changed, leading to market volatility. Understanding the yen carry trade is crucial, as its unwinding can trigger broad market sell-offs. However, this pullback also presents investment opportunities in high-quality equities, emerging markets, commodities, fixed income, and select real estate sectors. By staying focused on fundamentals and strategic investments, investors can navigate the current market environment and find potential gains.

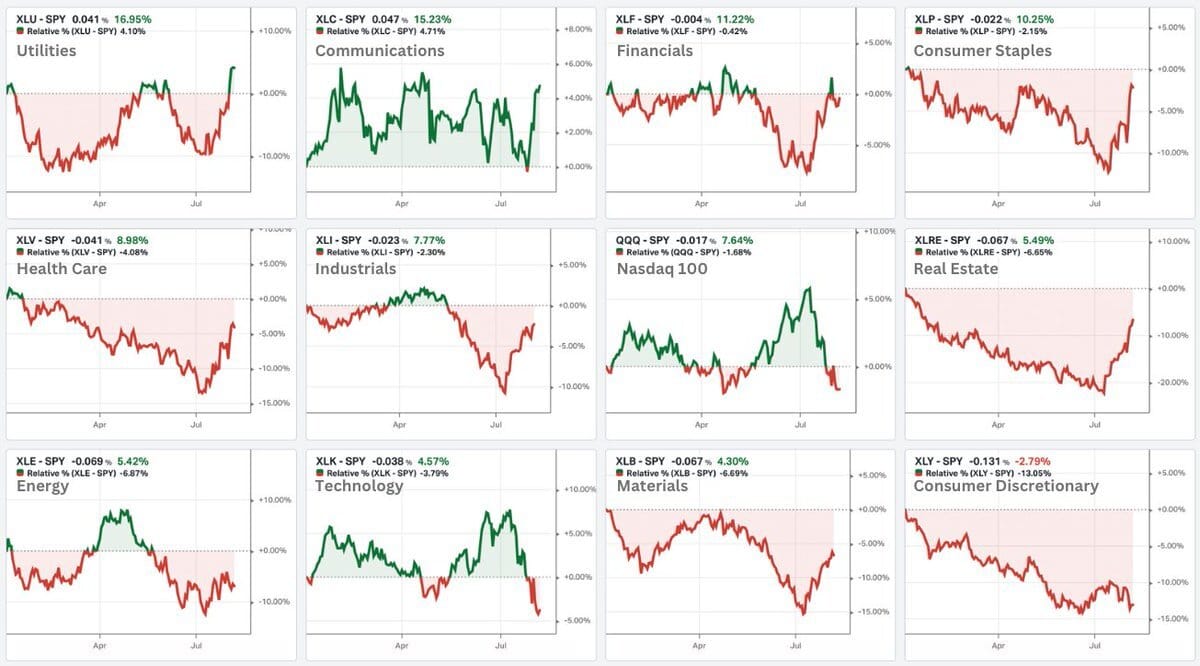

A couple great tweets highlighting the current state of the market

What I’m interested in this week

“How to do the slow, hard, good work of staying put” by Kurt Armstrong

“Jeff Bezos’ family office is making big investments in AI” in CNBC

“US bond yield drop suggests lower mortgage rates may be coming” in Reuters

BULLET TRAIN, cinematographer Jonathan Sela

A brief disclaimer: sometimes I include links in this newsletter for which I may receive a commission should you choose to purchase. I only recommend products I use - we currently do not accept sponsors.

Additionally, the contents in this newsletter are my viewpoints only and are not meant to be taken as investment advice.